Beyond cheques

Updates relating to Suncorp Bank Cheque Services

Effective from 14 February 2025, Account Terms & Conditions (impacted documents detailed below) will be updated, and you will no longer be able to make cheque deposits to your Account.

These changes apply to all cheque deposits made to all Suncorp Bank Accounts at any Suncorp Bank branch and agencies, any Automatic Teller Machines (ATMs), at any Bank@Post outlet and at any other bank.

Effective 14 February 2025, changes will be applied to the following documents: Terms and Conditions for Suncorp Bank Accounts and Continuing Credit Accounts, Personal Deposit Account Product Information Document, Business Account Product Information Document, Wealth Cash Management Account Product Information Document, Carbon Insights Account Product Information Document & Terms and Conditions, Fixed Term Deposits Product Information Document, Lending Fees and Charges for Other Suncorp Bank Personal Loans, Home Loans and Packages, Schedule of Fees and Charges for Other Suncorp Bank Personal Accounts, Schedule of Fees and Charges for Other Suncorp Bank Business Accounts, Lending Fees and Charges for Home Lending and Business Lending Fees and Charges.

View a Summary of Changes related to Suncorp Bank Cheque Services, effective 14 Feb 2025 (PDF).

With most Australians finding other forms of payment faster and more convenient, cheque usage continues to decline across Australia.*

Businesses and consumers are adapting by seeking safe and alternate ways to make payments, so it’s a good time now to realise the benefits of alternate payment methods.

We’re here to help.

Frequently asked questions.

What does the change to Cheque Withdrawals mean?

As a Suncorp Bank customer, you will no longer be able to use a cheque drawn from your Suncorp Bank account to make a payment from 1 March 2024.

Why is Suncorp Bank ceasing cheque services?

The decision to no longer offer cheques and accept the deposit of cheques wasn’t made lightly; however, it is now an opportunity to review your payment methods and take advantage of some other, more efficient ways to make and receive payments.

When will I no longer be able to write a cheque?

From 1 March 2024 you will no longer be able to issue cheques which are drawn from your personal or business Suncorp Bank account. Cheques issued after this date will not be honoured.

Will my cheques still work at other banks?

Can I still order a cheque book?

What should I do with any cheques remaining in my cheque book?

I have a ‘cheque’ option on my account/card, what do I do?

I have a large amount of money to send, can I do this electronically?

I have written a cheque after 1 March 2024 – what will happen?

Suncorp Bank will not accept the deposit of any cheques issued after 1 March 2024. You will need to contact the cheque recipient to organise an alternate method of payment.

How do I make payments?

Instead of paying by cheque, you can use Internet Banking, Telephone Banking and the Suncorp Bank App to:

- Pay your bills,

- Donate money to a charity,

- Make a Tax Payment,

- Move money between your own accounts,

- Send funds to another person in Real Time via Suncorp Bank App and Internet Banking,

- Set up automatic payments (periodical payments – you chose the frequency, date , organisation, amount and we will send the funds automatically Ways to Bank - Online (Internet Banking and Suncorp Bank App only), and

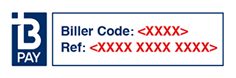

- BPAY® payments, you can commonly find these details on how to set up on the last payment notice e.g. Rates Notice / Utilities Bill.

- Direct Debits – to set up or cancel a Direct Debit you need to contact the organisation you with to make payment to.

Use your debit card to:

- Pay your bills,

- Purchase online,

- Purchase in store, and

- Withdrawal for cash payments.

I have never done banking online before, where do I go?

Our teams are here to support you:

- To register you can access here Internet Banking | Ways to Bank | Suncorp Bank

- Call us on 13 11 75 or visit us in branch for help to register for Internet Banking

- Other support – videos Internet Banking | Ways to Bank | Suncorp Bank

- Guides Internet Banking | Ways to Bank | Suncorp Bank

- Links: Osko fast payments and PayID | Suncorp Bank

- Ways to Bank | About Us | Suncorp Bank

- Understanding Daily Limits And Transaction Limits | Suncorp Bank

What payment options are available to pay my employees and suppliers?

Business Payments Credit

Business Payments credit is a cost-effective option for businesses that need to process less than 1,000 transactions at a time (per file). If you need to make more transactions per file, check out our Multipay option.

- No establishment or account keeping fee

- Use our existing Internet Banking system (no new software to install)

- Available for making payments (crediting accounts) only

- Process Bulk payments, for example pay staff wages with one transaction

- Multi-to-sign functionality available

Multipay

This user-friendly online platform simplifies payment processing. It enables your business to:

- Receive regular payments using direct entry debit, payment cards and BPAY

- Make payments using direct entry credit and BPAY Batch

As a business customer, what other options can I provide to my customers to enable them to pay invoices I have issued?

- Business customers can create a PayID using their mobile, email or A.B.N./A.C.N. via Internet Banking and advise customers of this on their Invoice. PayID is a modernised payment process, that removes risk associated with lost, stolen or fraudulent cheques.

- Provide your BSB and Account number on Invoices to have the money transferred.

- Set up BPAY® Biller functionality and provide these details on the Invoice.

- Set up a Merchant facility and accept Card payments

How do I receive payments?

Instead of receiving and depositing a cheque into your account you can provide the payer with the following details:

- Your BSB and Account Number

- A PayID, you can create a PayID with an email address or mobile number for your personal account via the Suncorp Bank App. For business accounts, you can create a PayID with an email address, mobile number or A.B.N/A.C.N through Internet Banking, by calling us on 13 11 75 or visiting a branch.

What does the change for Cheque Deposits mean?

As a Suncorp Bank customer, you will no longer be able to make personal cheque deposits to any of your Suncorp Bank Accounts. These changes apply to all cheque deposits made to all Suncorp Bank Accounts at any Suncorp Bank branch and agencies, any Automatic Teller Machines (ATMs), at any Bank@Post outlet and at any other bank.

However, Suncorp Bank issued bank cheques presented at a Suncorp Bank branch or agency for deposit into a Suncorp Bank account will continue to be accepted.

What should I do if I receive a cheque from the government or a company?

We recommend contacting the issuing organisation to inquire about alternative payment methods. Some options include:

- Bank Transfers: Provide your BSB, account number, and account name to receive payments directly into your account.

- PayID: You can only create a PayID for your personal account via the Suncorp Bank App. For business accounts, you can create a PayID through Internet Banking, by calling us on 13 11 75 or visiting a branch. View our Osko fast payments and PayID related information.

I have a cheque issued before 14 February 2025 - can I still deposit it?

Effective from 14 February 2025, personal cheque deposits will no longer be able to be made to any Suncorp Bank Accounts at all Suncorp Bank branches and agencies, any Automatic Teller Machines (ATMs), at any Bank@Post outlet and at any other bank.

However, Suncorp Bank issued bank cheques presented at a Suncorp Bank branch or agency for deposit into a Suncorp Bank account will continue to be accepted.

What should I do if I have recurring cheque deposits (e.g., salary or dividends)?

We recommend that you contact the issuer of the cheques to transition to direct deposit or another electronic payment method. This will ensure timely deposits without disruption.

Need more assistance or information?

Just contact us on 13 11 75 or visit your local Suncorp Bank branch.

Things you should know

* Reserve Bank of Australia Payments Data, as retrieved from the RBA website.

Osko is a registered trademark of BPAY Pty Ltd ABN 69 079 137 518

++Osko fast payments can only be made to a PayID or to the BSB and account number of an Osko enabled account at another Osko participating financial institution via the Suncorp Bank App, Internet Banking or by visiting a Suncorp Bank branch. Osko fast payments cannot be made from or to Passbook accounts, loan accounts (other than line of credit and overdraft facilities), Farm Management Deposit Accounts and Fixed Term Deposits. Osko fast payments cannot be made from Kids Savings Accounts, Agent’s Statutory Trust Accounts (QLD, NSW) and Solicitor’s Trust Accounts (QLD) but can be made to them. Staff assisted Osko fast payments cannot be made in branch from Carbon Insights Account and Sub-Accounts, Everyday Options Sub-Accounts, Business Saver Accounts or eOptions Accounts. Payments from an Account which requires 2 or more persons to sign to withdraw, future-dated and recurring payments and Business Payment Credits will not be made as an Osko fast payment. For full details about terms and restrictions that apply to Osko fast payments please read our Terms and Conditions for Suncorp Bank Accounts and Continuing Credit Accounts and the Product Information Document applicable to your account.

Apple, the Apple logo, Apple Pay and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries and regions.

App Store is a service mark of Apple Inc.

Google Wallet, The Google Wallet logo, Google Pay, The Google Pay logo, Google Play and the Google Play logo are trademarks of Google LLC.

Android is a trademark of Google LLC.

¢ Suncorp Bank is a member of the atmx by Armaguard (atmx) ATM Network. The deposit is taken by Armaguard on behalf of Suncorp Bank (Norfina Limited ABN 66 010 831 722 AFSL No 229882) at all atmx ATMs. Fee-free access applies to the following transactions: a successful cash withdrawal, account balance enquiry, PIN change, transfer between Suncorp Bank accounts, or a cash deposit using a Suncorp Bank Visa Debit Card. Daily withdrawal limits apply. Deposit up to 90 notes per transaction. Cheques deposits are not accepted at atmx ATMs for Suncorp Bank Customers. Terms and conditions apply. Find out more on our Suncorp Bank ATMs page.

BPAY® and BPAY® View are trademarks of BPAY Pty Ltd ABN 69 079 137 518. BPAY facilities are issued by Suncorp Bank (Norfina Limited ABN 66 010 831 722 AFSL No 229882) to approved applicants. Terms and conditions, fees and charges apply and are available on request. For more information, click the help icon in Internet Banking for more detailed instructions, or go to https://www.bpay.com.au.

^ You can only create a PayID for your personal account via the Suncorp Bank App. For business accounts, you can only create a PayID through Internet Banking, by calling us on 13 11 75 or visiting a branch.

Terms, conditions and eligibility criteria apply to PayID creation, please refer to the Product Information Document, Schedule of Fees and Charges and PayID Terms and Conditions, as applicable to your account. A PayID cannot be created in connection with a Passbook Account, Kids Savings Accounts, loan accounts (other than line of credit and overdraft facilities), Farm Management Deposit Accounts and Fixed Term Deposits. Certain types of mobile numbers (eg. international numbers) and email addresses may not be in a format which is compatible with our PayID requirements and, therefore, cannot be created as a PayID.